Register

Parents

Parents of current McDonogh students may sign up for website accounts. Signing up for an account allows a parent to access the online directory, DASH, and your customized parent Personal Page.

Alumni

Alumni can create an account in order to take advantage of McDonogh Connect or Pledgemail.

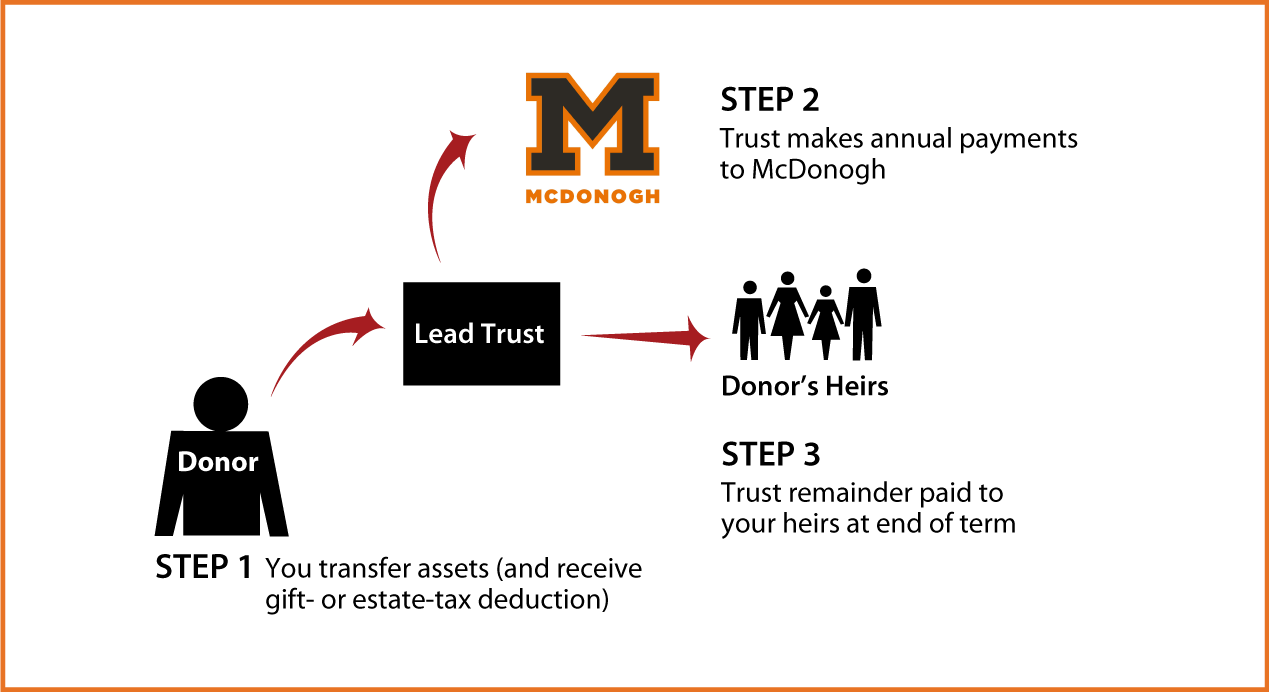

Nongrantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to McDonogh

- Remainder transferred to your heirs

Benefits

- Annual gift to McDonogh

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

More Information

Request an eBrochure

Request Calculation

Contact Us

Beth Sauer Hopkins '02 |

McDonogh School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer